Meredith to buy US publisher Time in Koch-backed deal

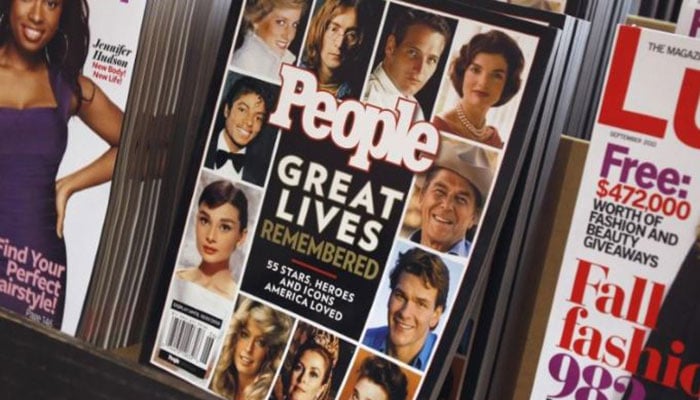

US media organization Meredith Corp said on Sunday it will purchase Time Inc, the distributer of People, Sports Illustrated and Fortune magazines, in a $1.84 billion all-money bargain sponsored by moderate tycoon siblings Charles and David Koch.

The arrangement is an upset for Meredith, which held unsuccessful converses with purchase Time prior this year and in 2013.

It will give news, business and games brands to the Des Moines, Iowa-based distributer and supporter, which claims way of life magazines, for example, Better Homes and Gardens and Family Circle. Examiners have said that building up on distributing resources could give Meredith the scale required to turn off its telecom arm into an independent organization.

Whenever consolidated, the Meredith and Time brands will have a readership of 135 million individuals and paid dissemination of almost 60 million. The arrangement likewise will grow Meredith's compass with web keen millenials, making an advanced media business with 170 million month to month one of a kind guests in the United States and more than 10 billion yearly video sees.

The Koch siblings are two of the world's wealthiest men through their responsibility for Industries, a sprawling modern domain that makes such items as Brawny paper towels, Dixie Cups and Lycra.

Koch Equity Development, the private value arm of the Koch siblings, consented to offer Meredith $650 million in favored value to subsidize the Time obtaining. The organizations said the Koch unit won't take a load off on Meredith's board and will have no effect on Meredith's article or administrative operations.

The Koch siblings are two of the world's wealthiest men through their responsibility for Industries, a sprawling mechanical realm that makes such items as Brawny paper towels, Dixie Cups and Lycra. Photograph: Reuters/File

The Kochs, known for their promotion of preservationist approaches and impact on a few fourth of the Republican Party, had already communicated enthusiasm for purchasing media properties, for example, the Los Angeles Times and the Chicago Tribune in 2013.

Their association in the Time bargain "underscores a solid faith in Meredith's quality as a business administrator, its techniques, and its capacity to open critical incentive from the Time securing," as per the organizations' announcement declaring the arrangement.

Meredith said it anticipated that the arrangement would shut in the initial three months of 2018. Reuters announced before on Sunday that the organizations were nearing an assention.

Counting obligation, the arrangement esteems Time at $2.8 billion. Meredith said it expected cost reserve funds accomplished by dispensing with cover in the two organizations of $400 million to $500 million in the main full two years of operation. Meredith included it would dispatch a delicate to gain Time shares for $18.50 in real money.

"We are including the rich substance creation capacities of a portion of the media business' most grounded national brands to a capable nearby TV business that is producing record income, offering publicists and advertisers unparalleled reach to American grown-ups," Meredith Chief Executive Stephen Lacy said in the announcement.

Meredith said it would keep on paying its present yearly profit of $2.08 per share, and expects progressing yearly profit increments.

Time battled without anyone else

Time Warner Inc spun off Time, which likewise distributes the eponymous current issues magazine, as an independent organization in June 2014. From that point forward, New York-based Time had battled in an extensive decrease in print media, as dissemination psychologists and promoters move to advanced stages.

Meredith, which has a capitalisation of $2.7 billion, attempted to converge with Richmond, Virginia-based telecaster Media General in 2015, yet Nexstar Media Group Inc wound up getting that organization for $4.6 billion.

Time shares finished exchanging on Friday at $16.90, giving the organization a market capitalisation of $1.7 billion.

Time, drove by CEO Rich Battista, has been experiencing a vital arrangement that incorporates redoing its cost structure and concentrating on its advanced business. It has likewise been investigating an offer of a few magazines titles, for example, Coastal Living, Sunset and Golf and a greater part stake in Essence and also Time Inc UK.

The advantages it had reserved for a potential deal spoke to about $488 million in income for the year finished June 30, the organization has said.

In September, it named its previous advanced editorial manager, Edward Felsenthal, to be the new proofreader in head of Time. It has additionally ventured into spilling video channels, propelling Sports Illustrated TV through Amazon recently.

Time said before in November that in the second from last quarter, its aggregate income slipped 9.5 percent to $679 million, missing examiners' appraisals of $693.5 million, as indicated by Thomson Reuters I/B/E/S. It denoted the 6th straight quarter the organization had missed desires for income.

Battista, who will leave Time when the arrangement with Meredith closes, will work intimately with the Meredith administration group to guarantee a smooth change, the organizations said on Sunday.

The magazine business has been uniting for quite a long while. Men's Health magazine distributer Rodale said it would pitch itself to bigger opponent Hearst a month ago. Wenner Media, the proprietor of Rolling Stone, said in September it was investigating an offer of the music magazine.

BDT and Company and Moelis and Company are filling in as money related counselors to Meredith, and Cooley LLP is filling in as lawful insight. Morgan Stanley and Co. LLC and BofA Merrill Lynch are filling in as money related counsels to Time Inc and Debevoise and Plimpton LLP is filling in as legitimate consultant.

Rothschild Inc and Credit Suisse are filling in as budgetary counselors to Koch Equity Development, and Jones Day is filling in as lawful insight. RBC Capital Markets, Credit Suisse, Barclays and Citigroup Global Markets Inc gave obligation financing to the arrangement.

No comments